Start Your Credit Score Journey

Building a good credit score is a journey. We got you covered with basic information you need to start your journey on the right foot! potential customers. The credit score is computed based on the customer’s characteristics and past repayment behaviors. It usually takes the form of a 3-digit number in a predefined range: for example, the Creditinfo Predictor Score (CIP) is a number between 250 and 900. The higher is the score, the lower the risk.

get in touchWhat information is used to calculate my Credit Score?

For you as a consumer, improving your credit score not only increases your chance to be granted a loan for your next car purchase or home mortgage, but it also grants you a better position to negotiate the terms of your loan. Building a great credit score cannot be done overnight, it is the result of consistent positive credit related behavior over an extended amount of time. For this reason, it is essential to get familiar early with the different aspects of credit score calculation. The Credit scores evaluates the Credit worthiness of consumers and businesses based on various indicators often entering in one of the following categories:

Additionally, predictors will usually look at different time windows in your credit history: while some indicators capture your behavior in the last few years, others will focus on your very recent actions in the last few months. The emphasis put on more recent behavior means that even if your score is currently very low due to a recent payment incident, it is always possible for you to repair your score. By adopting consistent positive credit related behaviors, your score will slowly recover and come back to its previous levels or eventually higher.

What can I do to improve my credit score?

- Only borrow what you are sure you will be able to repay on time.

- Perform regular and timely payment on your bills and credit facilities.

- Maintain a balanced credit utilization.

- Check and monitor your credit report and credit score on a regular basis to prevent fraud and identity theft.

It is critical to keep in mind that building a good credit score is a gradual and continuous process. The best way to increase it is to continuously demonstrate good payment behavior.

How can I check my credit report and credit score?

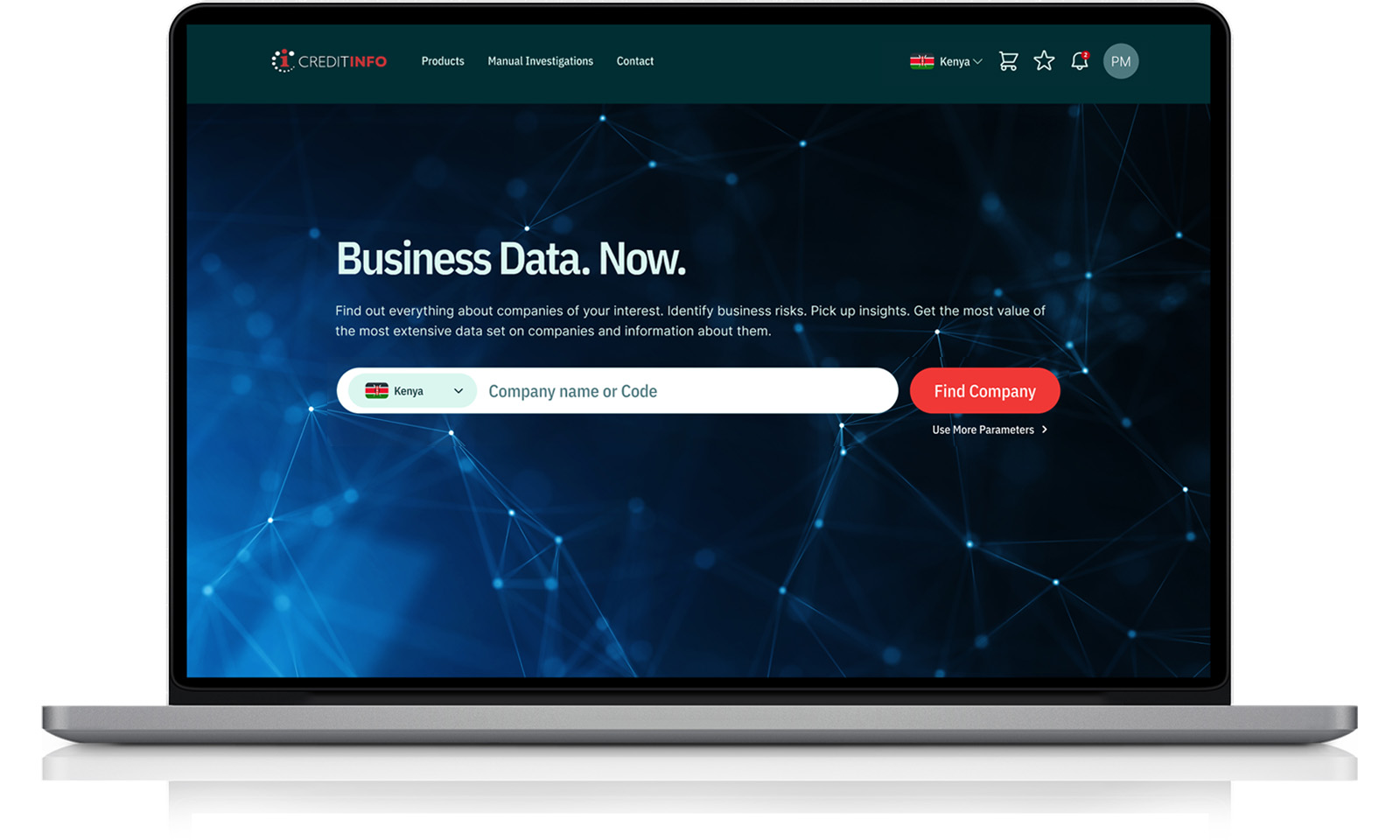

One way to check your access your credit report is to access Creditinfo website of your region at the report section. Depending on the region, you might be eligible for a free credit report every year. The Creditinfo report + will give you access to the full extent of your credit history, along with your credit score. Alternatively, if MyCreditinfo is available in your region, you can simply download the app on your smart device and create your account.

Main Benefits of Good Credit Score

A good credit score can open many opportunities and save you a sizeable amount of money in the long term. Building your credit score is a long journey, but one worth taking. You do not need to be a financial expert to get started: choose the credit solution that best matches your needs and current situation, setting up good payment habits and regularly monitoring your credit report will already take you a long way.

Related Products

MyCreditinfo Monitoring

Stay up to date with changes on your credit report without the need of manual data check.

Read More

Creditinfo Group

Creditinfo Group